And I'll dissect them one by one.

Starting with my successful trades.

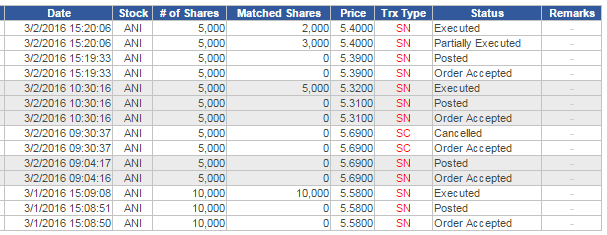

ANI:

I was waiting for it to break out.

Then, I went ALL IN.

I had conviction on this trade.

I had accepted that if I'wrong, I lose P4,400 with a cutpoint set at 4.78, just below the low of the day.

But I got it right.

However, I must say that I wasn't able to maximize my gains.

I got out with a +9.40% Profit.

Next trade: DD

Few things about this trade:

1. I bought near the top of the range which isn't really a good buying area.

2. I bought 700 shares only because I didn't plan on going heavy. Just a quick trade.

3. But because I had a tight stop at 24.60, I figured I could lose only P630 if I'm wrong.

4. I got it right.

5. I sold at the open last Friday because 30.00 should be both a psychological resistance and a technical resistance considering it's a whole number.

6. +15.29% Profit on this trade.

VITA:

I bought VITA at 0.67 with my recommended position size.

Then I added more at 0.66 (which is against my rule of averaging down).

Added more at 0.69 (because it did a Zeus Strike).

My target price is 0.77- 0.78.

It rallied.

Although it hit my target price, I sold everything at 0.75 with +11% Profit.Now it's time for the unsuccessful ones.

MAXS:

PPC:

I sold half of the position to follow my recommended size.

RFM:

I am still bullish on this stock since it is still above the 100ma. However, other stocks are moving faster that I had to close this position. Would just wait for the 200ma breakout confirmation.

IS:

I f*cked up on this one. I was so bullish on the last candle before I bought that I put my order at 0.2300 and got filled at 0.2260. Right after that, it plummeted. It closed at 0.2140 and I still haven't exited.

If you would notice on MAX, RFM, and PPC, I didn't really get stopped out.

Instead, I sold because I was impatient.

This is one of my greatest trading problems.

Not letting the trade work.

Because of this, I just end up paying commission and lose money.

The IS trade is yet another case of impatience.

Not waiting for the best risk-reward price level.

No comments:

Post a Comment